average property tax in france

Speak to an expert. These rates are applied based on the households total income.

Taxes On Property In France French Touch Properties

Result according to the National Observatory of Property Taxes led by the National Union of Property Owners UNPI the average increase is 47 in 2022 compared to 2021 in.

. This means that they are subject to a minimum tax rate. Only around 14 pay at the rate of 30 and less than 1 pay at the. Tax rates range from 0 to 45.

Exemption Thresholds 2022 2021 Income In practice only 44 of inhabitants in France pay any income tax at all. Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary. This is a land tax and and is always paid by whoever owns the property on January 1st of any given.

It indicates both the annual property tax on a median-value home in the state and for comparison what the property tax would be on the US. If you need assistance with your move we have a team of France property experts that can help at every crucial stage. The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property.

The rate of stamp duty varies slightly between the departments of France and depending on the age of the property. Property owners in France have two types of annual tax to pay. Residence Tax Taxe dhabitation.

This is not the same as property taxes. The minimum 20 tax rate or 144 for income earned in Frances overseas départements is increased to 30 or 20. In France tax rates work in slices.

France Tax Income Taxes In France Tax Foundation Average Monthly Net Salary After Tax Mortgage Interest Rate in Percentages Yearly for 20 Years Fixed-Rate. National median home sales price. 108 rows Information on average rates bills is not yet available for 2020 but the table below shows the average rates payable in each department of France in 2019.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. For properties more than 5 years old stamp. In French its known as droit de mutation.

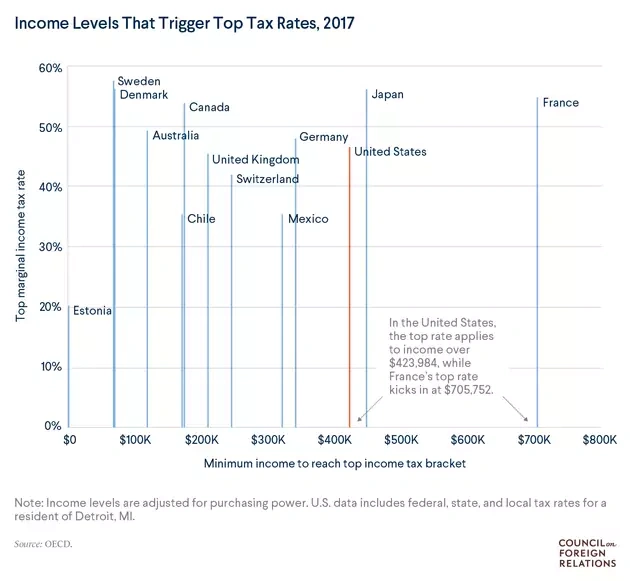

A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each. France has a bracketed income tax system with five income tax brackets ranging from a low of 000 for those earning under 5875 to a high of 4000 for. Contact us on 44 020 7898 0549 from.

Lets say you have a net taxable income of 20000. Owner of a French property have to pay a tax on their property because it is capable of being lived in.

Income Tax In The Uk And France Compared Frenchentree

What Are Property Taxes Like In The South Of France Mansion Global

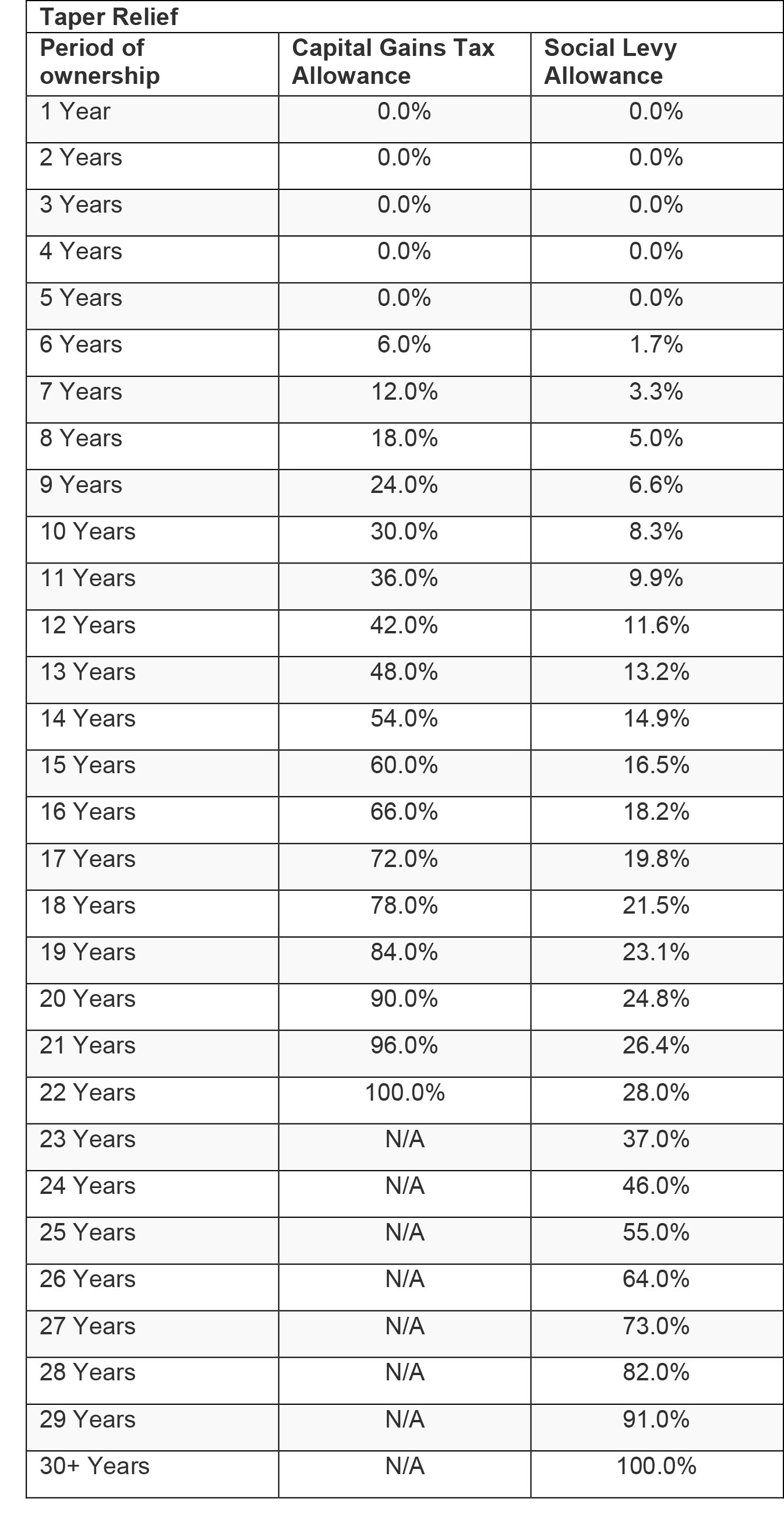

Selling A Property In France Here S What You Need To Know About Paying Capital Gains Tax The Alliance Of International Property Owners

French Property Taxes Set To Reach Record Levels In 2022

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

Average Price Of U S Real Estate Sold By Country International Tax Blog

Taxes On Property In France French Touch Properties

2022 Capital Gains Tax Rates In Europe Tax Foundation

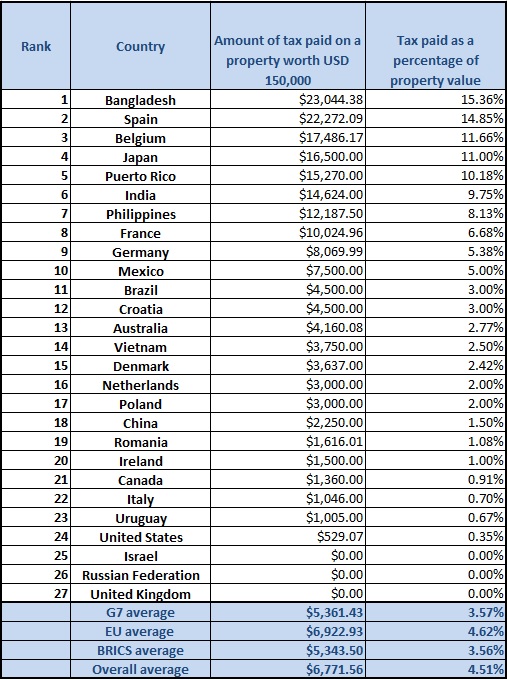

Taxes On Buying A Home Now Averaging Nearly 5 Worldwide With Some Economies Charging Over 10 Uhy Internationaluhy International

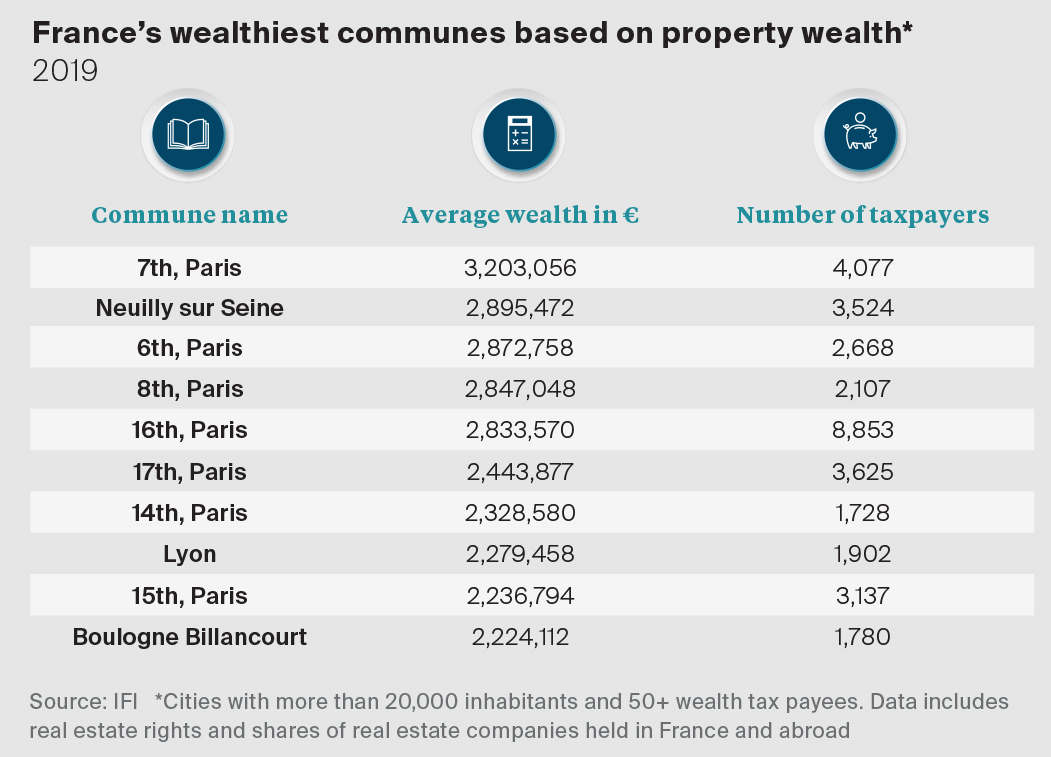

Prime France Proves Resilient With Sales Up 5 Nationally

France S 2023 Budget Means Tax Rises For Second Home Owners

Seoul Studying To Ease Property Tax Hovering Above Oecd Average Pulse By Maeil Business News Korea

Emergency Stamp Duty Cut Means Buyers In Uk Now Pay Amongst Lowest In Europe Even On A Prime Property Insights Uhy Hacker Young

Tax Revenue Statistics Statistics Explained

Brexit Second Homes In France What You Need To Know

Tax In France For Expats Expert Expat Advice

Property Taxes Haldimand County

Property Tax Assistant Average Salary In France 2022 The Complete Guide